The rate of a borrower’s creditworthiness is an important factor on which most banks rely. The CIBIL or credit score is the name given to this score or rating. Customers should keep track of their CIBIL scores on a regular basis. You can also CIBIL score check free on many websites. Banks provide customers with both secured and unsecured loans, depending on their ability to repay the amount. As a result, banks ensure their customers’ creditworthiness by checking a variety of facts relating to their financial history and debt-related behaviour.Therefore, financial institutions depend on credit bureaus to obtain this information, which is referred to as a credit or CIBIL score.

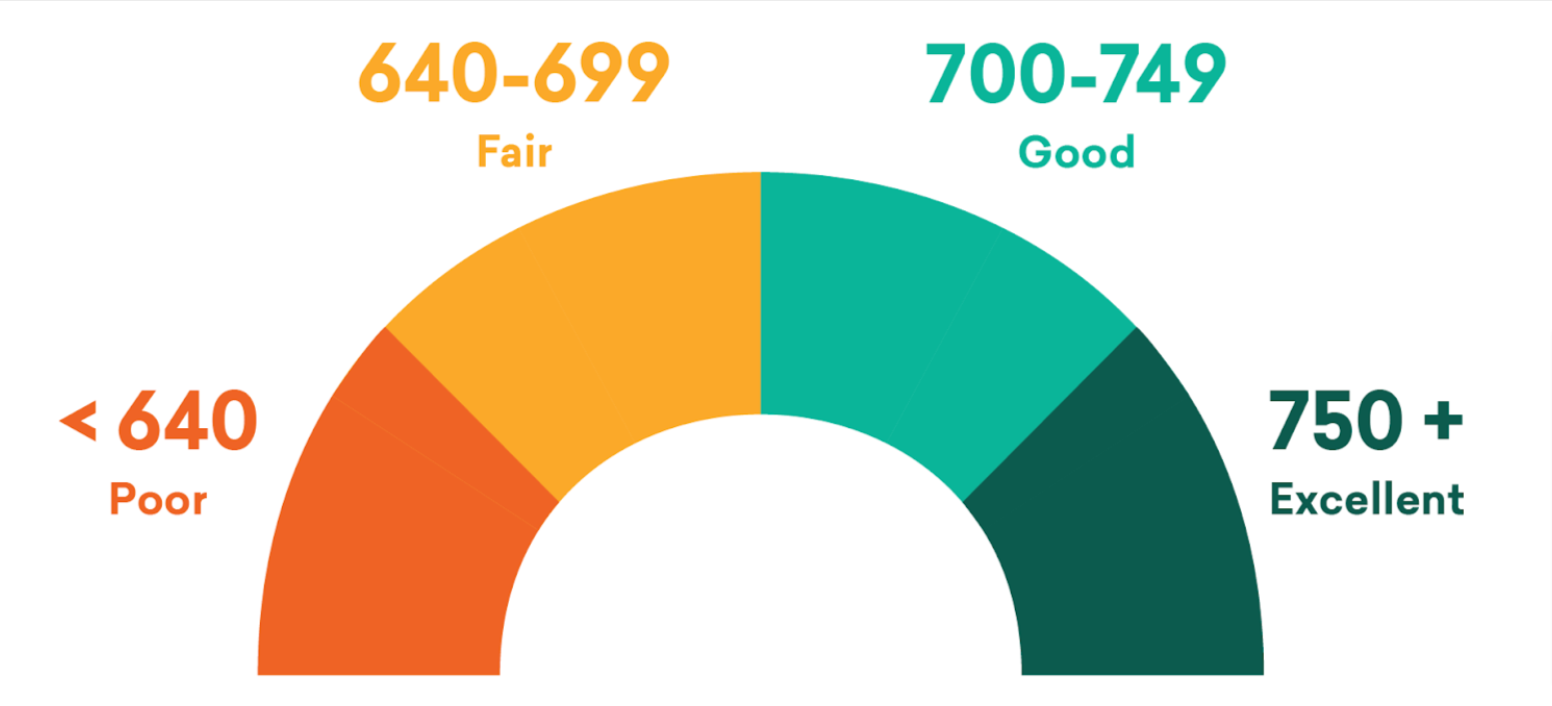

Ranges of CIBIL Scores

Credit bureaus assign the following scores based on the customer’s credit history. The credit score of a customer fluctuates depending on his or her credit history. CIBIL Scores range from 300 to 900. The higher your score is to 900, the higher is the probability of getting you a hassle free loan. Here are some of the CIBIL scores and their depictions by the lenders.

CIBIL Score of 700 and above:– A CIBIL score of 700 or higher poses no danger to the banks. This means that banks will give out loans at the lowest possible interest rate. It’s worth noting that if your credit score is above 750, you’ll have an easier time getting a loan.

600 to 700 CIBIL score:- Lenders will also be willing to lend to borrowers with a CIBIL score of 600 to 700, which is considered a low-risk range. You may, however, be charged a higher interest rate than folks with a better credit score.

300-600 CIBIL Score:– Individuals with a CIBIL score of 300-600 are considered to be at high risk. Banks are wary of lending to people in this scenario.

1-5 CIBIL Score:- Customers with a credit score of 1 to 5 have a credit history of less than six months. As a result, their CIBIL score is low.

CIBIL Score of -1:- A credit score of -1 means that you have a bad credit history. The CIBIL score of a customer with no credit history is -1. They are typically first-time borrowers with no prior credit or loan history. They need to make a serious effort if they want to obtain any kind of personal loan, home loan, credit cards or any other credit.

The CIBIL Score Facts

- The credit score is unaffected by the bank balance.

- A debit card transaction does not go toward your credit history. However, if a credit card is closed, it will have an impact on your credit score.

- The income is not reflected on the credit record.

- The act of checking one’s credit score on a frequent basis has no effect on one’s credit score.

- Credit scores are provided by several agencies in different ways.

- Any false information can be challenged by the client.

- Customers and banks may be given different credit scores.

- You can also check free CIBIL scores on various third party websites.

- Personal loans require high CIBIL scores as these are the unsecured loans.

Save Money and improve personal finances with a good CIBIL score

Showing a consistent CIBIL score will help you save money and improve your personal finances. Here are just a handful of the numerous benefits of having a high credit score.

Pay reduced financing costs

With a solid credit score, you will almost always be able to acquire the best interest rates and pay reduced financing costs on outstanding balances and loans. You will be likely to pay back the loan faster and have more money to spend on things if you have a lower EMI.

Little trouble obtaining financing or a credit card

Your chances of obtaining credit rise when you have an outstanding credit score. Overall, you should have little trouble obtaining financing or a credit card.

Able to take advantage of more tempting offers

If you have strong credit, you may be able to get a lower interest rate on credit cards and loans. With a creditworthiness rating that is CIBIL score, you may be able to take advantage of more tempting offers from different companies if you require more negotiating power.

Let you take out loans readily

You’ll need a salary and a CIBIL score to take funds. Banks are more ready to let you take out loans if you have a strong credit score since you’ve demonstrated your ability to pay your EMI timely.

The Bottom Line

The total number of payments made in the past, the amount of credit or loans available and their utilisation, the sorts of credits accessible and how long they’ve been available, and how many credit enquiries were made in the past all factor affect the CIBIL score. Therefore, you need to look and study into all these factors to maintain your credit score. You cannot forget that to avail any type of credit such as personal loans or any other loans, CIBIL score plays a major role. Without a considerable credit score, you may not be able to get a hassle free personal loan. Building a credit score takes time and effort, hence you need to be very consistent and particular in your approach. Set your sole motive and improve your CIBIL score by paying all your bills on time. Check your free CIBIL scores often.

Tony Sheikh is a seasoned news writer with a commitment to delivering essential news updates. With a focus on general news, he provides concise and informative reporting on a wide range of topics, ensuring readers are well-informed about the latest developments in the world. Tony’s dedication to journalism is evident in his straightforward and factual reporting style.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/72931262/usa_today_21973134.0.jpg)